Get Involved at Community Care Network

Get involved with Community Care Network and make a meaningful impact in Ocean Springs, MS.

By volunteering, donating, or advocating for our cause, you can help transform lives and strengthen our community. Your support enables us to provide essential services and resources to women, children, and families in need.

Join us in our mission to create lasting change and a brighter future for all.

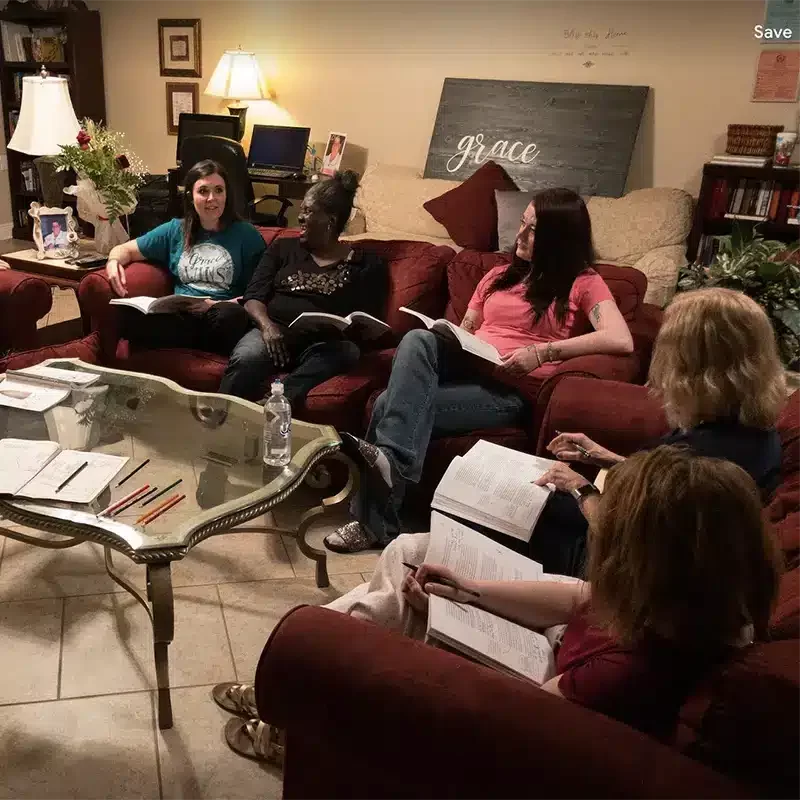

Volunteer

Join our dedicated team of volunteers and make an indelible mark on the lives of our clients.. Your time, skills, and heart can transform lives in ways you never imagined. Whether you're leading workshops, offering administrative support, or simply lending a listening ear, your contribution is invaluable.

Donate

Every donation, big or small, fuels our ability to support, empower, and uplift those in need. Your generosity enables us to extend our programs, enhance our services, and reach more individuals and families yearning for a brighter future. Invest in hope and change; donate now.

Frequently Asked Questions

Whether you're looking to benefit from our services, contribute to our cause, or simply learn more about our mission in Ocean Springs, MS, you'll find the answers you need right here. Our aim is to provide clear, helpful information to ensure you're well-informed and can easily navigate the opportunities and support available through our organization. If your question isn't addressed below, don't hesitate to reach out to us directly—we're here to help!

Yes, Sue's Home is equipped to support both women and their children, providing a safe and nurturing environment as they work towards self-sufficiency and stability.

Residents learn a variety of essential skills, including budgeting, cooking, job search strategies, and more, aimed at empowering them to live independently and successfully integrate into society.

Breakthrough offers housing, personalized mentoring, life skills education, and resources to foster youth, focusing on building trust, stability, and pathways to independence and success.

My Home connects individuals and families with various affordable housing options, from apartments to single-family homes, ensuring safe and stable living conditions.

Those interested in our services can apply through our website, call our office, or visit in person for an assessment and guidance on the application process.

We partner with local agencies, churches, and community organizations to enhance our programs, share resources, and better serve our community's needs.

We're continuously looking to expand our services and reach. Plans include developing new programs, enhancing current ones, and increasing our partnerships to better serve our community.

Businesses and community groups can support us through sponsorships, in-kind donations, volunteerism, and by hosting fundraising events. We encourage interested parties to contact us to explore partnership opportunities.

You can designate a portion of what you owe the state of MS to Community Care Network. Donations can be made to Mississippi or directly to the Community Care Network.

Passed by the legislature and signed by the governor in 2019, The Children's Promise Act provides a dollar-for-dollar tax credit for donations to Community Care Network.

For Individuals:

Q: How does the tax credit work for individuals?

A: The state of Mississippi offers a dollar-for-dollar tax credit to individuals for donations made to eligible Qualified Foster Care Charitable Organizations (QFCCO) and Eligible Transitional Home Organizations (ETHO). Community Care Network qualifies as both a QFCCO and an ETHO.

Q: What is the maximum tax credit allowed for individuals?

A: An individual can receive a tax credit of up to $3,000 if filing jointly ($1,500 if filing single) through a QFCCO. Additionally, an individual can receive a tax credit of up to 50% of what they owe the state of MS through an ETHO. You can choose which option to use.

Q: Where can I find more information?

A: Watch our Step-by-Step Video for detailed instructions.

For Businesses:

Q: How does the tax credit work for businesses?

A: Business taxpayers (Corporations, Partnerships, Limited Liability Companies, and Sole Proprietorships), married couples, and single individuals can receive a dollar-for-dollar reduction in their MS state income taxes, Insurance Premium taxes, Insurance Premium Retaliation tax, or ad valorem tax.

Q: What is the maximum tax credit allowed for businesses?

A: The amount of the reduction can be up to ½ of your tax bill.

Q: Can unused tax credits be carried forward?

A: Yes, if you do not use the tax credit in one year, you can carry it forward and take the credit over the next five (5) years immediately following your gift.

Q: Are there any other limitations?

A: Contributions cannot be used for other state charitable credits and cannot be used as a deduction for state income tax purposes.